Become a Certified Enrolled Agent

Join India's #1 training institute for US Taxation. 100% exam success support.

Join India's #1 training institute for US Taxation. 100% exam success support.

The Enrolled Agent credential — America's highest tax credential — unlocks high-paying opportunities in MNCs, Big 4 firms, leading tax consultancies, and global outsourcing companies in India.

Get a glimpse of our expert-led Enrolled Agent training sessions.

Students sharing their journey and passing moments

Shailja shares her mental game strategy

Passed after multiple attempts

From zero experience to CPA

Roadmap to CPA Success

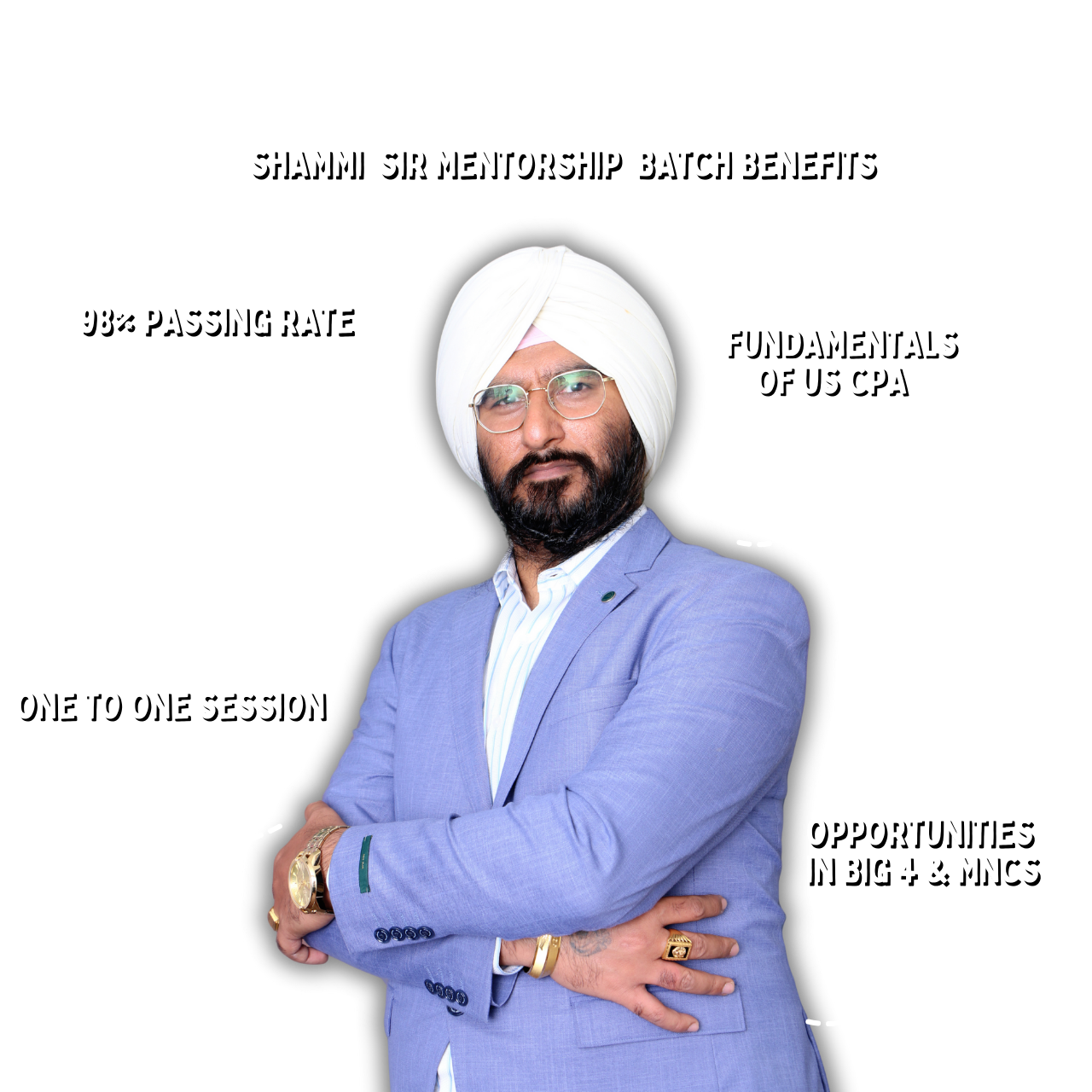

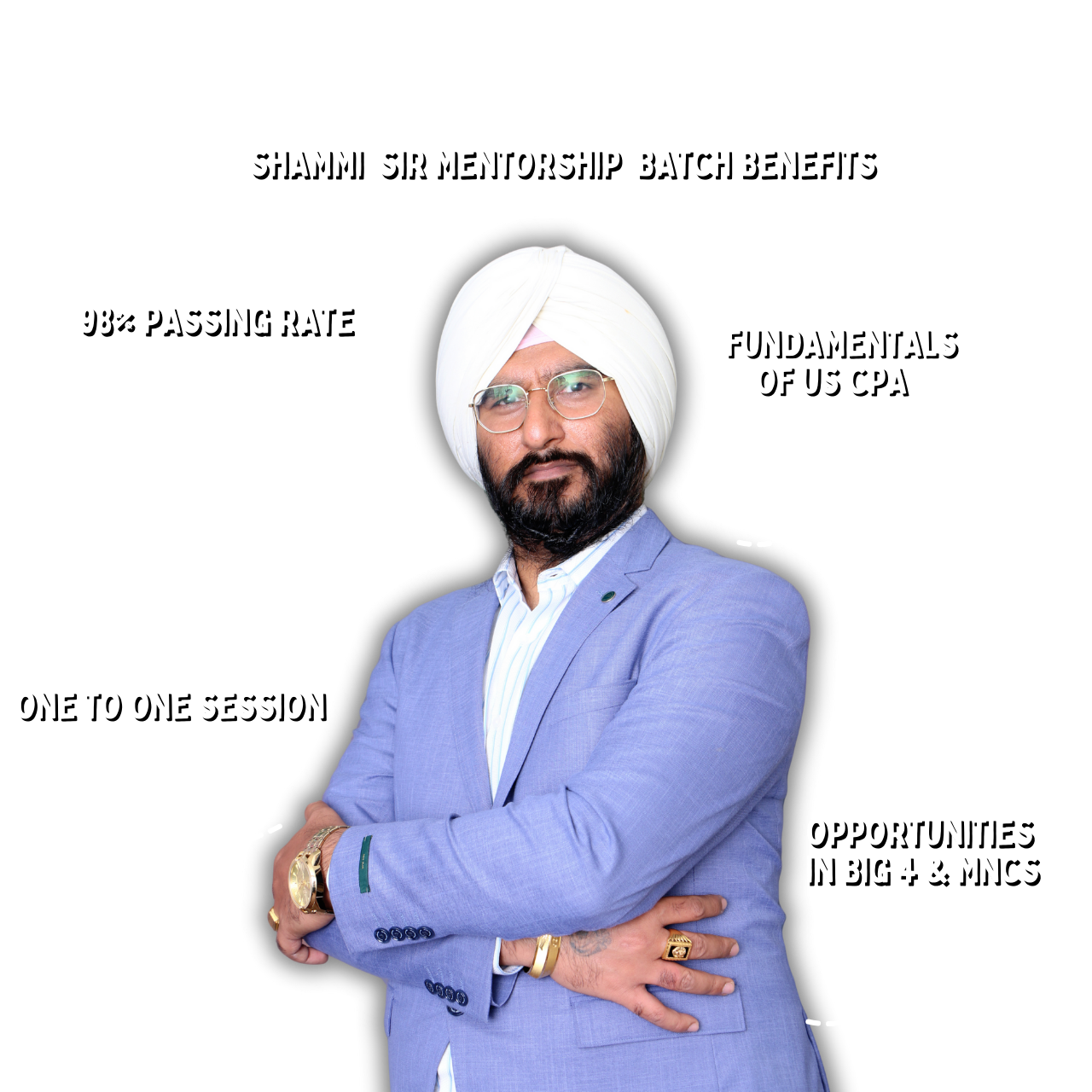

Learn directly from India’s most trusted EA mentor with a proven track record of success.

Whether you’re a fresher, CA, tax practitioner, or working professional — this course is tailored to make you IRS-ready.

Get one-on-one guidance from Shammi Saluja Sir — India’s leading EA mentor.

Attend interactive live sessions + unlimited access to recordings for flexible revision.

Master real-world U.S. tax scenarios with practical exercises and full-length mock exams.

Follow proven, step-by-step strategies to clear all 3 EA exam parts efficiently.

Three powerful stages to master U.S. Taxation & Representation

Tax filing requirements, deductions, credits, and real-world taxpayer compliance scenarios.

Corporate, partnership & business entity taxation, depreciation rules, and business returns.

IRS ethics, audit handling, and professional taxpayer representation.

Designed & delivered by Shammi Sir to help you clear all EA exam parts with confidence.

Start your journey toward becoming a globally recognized U.S. tax professional

You can start your EA journey right after Class 12, making it one of the most flexible global tax careers.

Your EA license is more than a credential — it's your gateway to high-demand, global tax careers.

Join top-tier Big 4 firms, international KPOs, or U.S.-based tax consultancies with competitive salaries and growth.

Build an independent U.S. tax advisory business — serve clients remotely or locally with full control and high earnings potential.

Help Indian residents, NRIs, and businesses with U.S. tax compliance, IRS representation, and cross-border planning.

Growing need for U.S. tax experts in India's MNCs, Big 4, and consulting firms.

IRS-authorized credential respected worldwide — instant credibility.

Choose full-time, freelance, remote, or hybrid — perfect work-life balance.

Qualify in months, earn in lakhs quickly — one of the fastest payback certifications.